- Personal

- Credit Cards

- Credit Cards

Credit Cards for You

Grow your flexibility, more possibilities, and faster checkouts with any of Arbor Financial’s contactless credit cards. Enjoy no annual fees, great rates, plus no balance transfer fees when you save money by bringing over higher-interest-rate credit card balances.

What feature is most important to you?

Rewards Credit Card

Earn Points for Cash Back, Merchandise, and Travel!

- Rates as low as 12.75% APR*

- Earn 2,500 points for activation, and earn 500 points when you sign up for eStatements.

Earn Great Rewards:

- 3X Points on Restaurants & Travel up to $1,000 each billing cycle, and 1X thereafter.

- 2X Points on Groceries & Gas up to $1,000 each billing cycle, and 1X thereafter.

- 1X Points on Everything Else!

All cards come with these great benefits.

Advantage Credit Card

Save More With a Low-Rate Card

-

- Rates as low as

9.50% APR*

- Save more with a low-rate card designed to help you manage your finances better.

- Sign up for eStatements and earn a $5 credit.

All cards come with these great benefits.

- Rates as low as

9.50% APR*

No Annual Fee

Enjoy significant cost savings and flexibility, perfect for those aiming to maximize their benefits.

Contactless Cards

Simply "Tap & Pay" at the register to enjoy convenience and safety. Plus, the advanced security features protect your information, giving you peace of mind with every purchase. Learn more about how contactless payments work.

Digital Wallet Options

Pay without the plastic; making purchases is easy, safe, and secure without having to swipe your card when you use your digital wallet. Learn more about the benefits of a digital wallet.

24-Hour Support

Get credit card assistance whenever you need it and enjoy peace of mind knowing you’re in good hands.

Visa's Zero Liability Policy1

Shop with confidence knowing you won’t be held responsible for unauthorized charges.

Lock Your Card for Safety

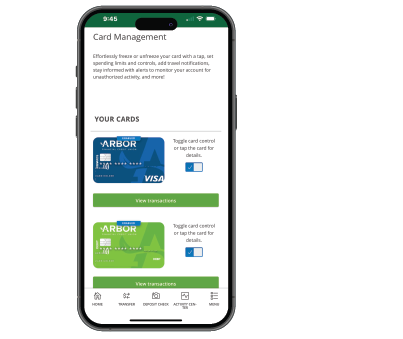

Manage your credit cards anytime, anywhere with Mobile & Online Banking.

Auto Rental Collision Damage Waiver

Get insurance coverage for automobile rentals made with your credit card.

Credit Card Balance Transfer

Transfer your balance and save with our 2.99% APR for 6 months Balance Transfer.

Modern Secure Look

Get a sleek, modern-looking card with your card information printed on the back for an added layer of security.

Manage your credit card through our Mobile & Online Banking App.

Manage your Arbor Financial credit cards anytime, anywhere! Enable real-time alerts, lock and unlock your card, and so much more. Now, when you are in your Arbor Mobile & Online Banking, click "Card Management" in the menu to access Card Controls and alerts easily and quickly.

Arbor Financial makes it easy to pay without swiping your card through these digital wallets:

Adding your card to your wallet is easy! Simply tap the "add to wallet" button in Mobile Banking.

Traveling with your debit or credit card?

Hit the road (or the skies) with confidence, because we work diligently to protect you no matter where you are in the world. Let us know before you head out on vacation to ensure uninterrupted use of your debit and credit cards. Out of state or international purchases may be flagged as potential fraud and consequently blocked until your authorization is confirmed.

It's easy. Set your travel alert using Mobile & Online Banking with your travel dates. Safe travels!

Get card assistance when you need it

Lost or Stolen Card

If your credit card is lost or stolen, call 866.591.2802 immediately and lock your card in Mobile & Online Banking so it can't be used.

Set Up Your PIN

If you would like to set up a PIN for ATM withdrawals on your credit card, call 888-886-0083 to set your PIN.

Online Banking

To access your credit card information online, please log in through Online Banking.

REMINDER: Your remittance address is P.O. Box 37603 Philadelphia, PA 19101-0603.

Personal Finance Resources

* Rates as of January 5, 2026. APR = Annual Percentage Rate. Rates are variable. Qualification is based on an assessment of individual creditworthiness and our underwriting standard. All Credit Union loan programs, rates, terms and conditions are subject to change at any time without notice. Not all applicants will qualify. Contact us for more information. See full disclosure.

** Annual Percentage Rate (APR). Offer available as of 1/1/26. Balance Transfer promotional rate applicable for 6 monthly billing cycles. Starting on the seventh month, the promotional rate will convert to your standard rate. Not eligible for CU Rewards Points and may not be used to pay other Arbor Financial accounts. Promotion, rate, terms and conditions subject to change without notice.

1. Visa’s Zero Liability Policy does not apply to certain commercial card and anonymous prepaid card transactions or transactions not processed by Visa. Cardholders must use care in protecting their card and notify their issuing financial institution immediately of any unauthorized use. Contact your issuer for more detail.

.jpg?width=400&height=300&name=Untitled%20design%20(17).jpg)