- About Arbor

- About

- Our Story

The Arbor Story

Decades ago, Arbor Financial Credit Union got our start meeting the local banking needs of teachers in Kalamazoo. Now, we provide community-driven financial services for our more than 47,000 members in Southwest Michigan.

- Personal

- Checking & Savings

- Checking

- Free CheckingNo minimum balance or service fees.

- Momentum CheckingEarn up to 4.00% APY on balances up to $15,000 when you use your debit card.

- Premier CheckingSizable dividends and easy access.

- Select Checking Earn 2.75% APY on balances of $250,000 and greater.

- Volt BankingDesigned for young adults (age 19-24). Offering reduced fees.

- Savings

- Youth & Teen

- Deposit Rates

- Services

- Debit & ATM Cards

- ATM Locator

- ID Protect

- Checking

- Home Loans

- Credit Cards

- Loans

- Auto

- Auto Loan OverviewLow rates and fast approvals put you in the driver's seat.

- New & Used Auto LoansWhether it's a new car or used one we have financing options for you.

- Refinance Auto LoansRefinancing can be a great financial move by lowering your auto payment or shortening the term of your loan.

- Motorcycle LoansTake on the open road with two wheels and low rates for all types of motorcycles.

- Loan ProtectionProtect your assets. Insure your loans. Ease your mind.

- RV & Boat

- Home Equity Loans

- Personal Loans

- Skip a Payment

- Calculate a Payment

- Rates

- Auto

- Services

- Digital Banking Tools

- Mobile & Online Banking Bank anytime. Bank anywhere. Pay your bills online, check your balance, apply for a loan and monitor your finances when it's convenient for you.

- Digital Wallet Leave your wallet in your pocket, or at home, and just tap your phone toward the point of sale for a contactless transaction.

- TellerPhone 24With TellerPhone 24, you can manage your accounts anytime, without going online.

- Insurance

- Title Services

- Extended Vehicle Warranty

- Skip a Payment

- Rates

- Calculators

- Help Center

- Card Help Center Have questions about your debit or credit card? We can help!

- Security Center Learn what to do if you suspect fraud, view fraud prevention tips and common scams in the area.

- Mortgage Help Center Have mortgage questions? We can help!

- Identity Theft Protection Get peace of mind with our 24/7 protection through ID protect and Total Identity Monitoring.

- Learn

- Digital Banking Tools

- Wealth Management

- Wealth Management

- Retirement Planning & Investments Discover savings and investment options to plan for your golden years.

- Savings Get financially fit by adding power to your portfolio.

- Education Funding Explore different options to finance college tuition and more.

- Financial Advisor Discuss IRAs, mutual funds, life insurance, and more with an on-site Wealth Management Advisor.

- Wealth Management

- Checking & Savings

- Business

- About Arbor

- Personal

- Checking & Savings

- Checking

- Free CheckingNo minimum balance or service fees.

- Momentum CheckingEarn up to 4.00% APY on balances up to $15,000 when you use your debit card.

- Premier CheckingSizable dividends and easy access.

- Select Checking Earn 2.75% APY on balances of $250,000 and greater.

- Volt BankingDesigned for young adults (age 19-24). Offering reduced fees.

- Savings

- Youth & Teen

- Deposit Rates

- Services

- Debit & ATM Cards

- ATM Locator

- ID Protect

- Checking

- Home Loans

- Credit Cards

- Loans

- Auto

- Auto Loan OverviewLow rates and fast approvals put you in the driver's seat.

- New & Used Auto LoansWhether it's a new car or used one we have financing options for you.

- Refinance Auto LoansRefinancing can be a great financial move by lowering your auto payment or shortening the term of your loan.

- Motorcycle LoansTake on the open road with two wheels and low rates for all types of motorcycles.

- Loan ProtectionProtect your assets. Insure your loans. Ease your mind.

- RV & Boat

- Home Equity Loans

- Personal Loans

- Skip a Payment

- Calculate a Payment

- Rates

- Auto

- Services

- Digital Banking Tools

- Mobile & Online Banking Bank anytime. Bank anywhere. Pay your bills online, check your balance, apply for a loan and monitor your finances when it's convenient for you.

- Digital Wallet Leave your wallet in your pocket, or at home, and just tap your phone toward the point of sale for a contactless transaction.

- TellerPhone 24With TellerPhone 24, you can manage your accounts anytime, without going online.

- Insurance

- Title Services

- Extended Vehicle Warranty

- Skip a Payment

- Rates

- Calculators

- Help Center

- Card Help Center Have questions about your debit or credit card? We can help!

- Security Center Learn what to do if you suspect fraud, view fraud prevention tips and common scams in the area.

- Mortgage Help Center Have mortgage questions? We can help!

- Identity Theft Protection Get peace of mind with our 24/7 protection through ID protect and Total Identity Monitoring.

- Learn

- Digital Banking Tools

- Wealth Management

- Wealth Management

- Retirement Planning & Investments Discover savings and investment options to plan for your golden years.

- Savings Get financially fit by adding power to your portfolio.

- Education Funding Explore different options to finance college tuition and more.

- Financial Advisor Discuss IRAs, mutual funds, life insurance, and more with an on-site Wealth Management Advisor.

- Wealth Management

- Checking & Savings

- Business

- About Arbor

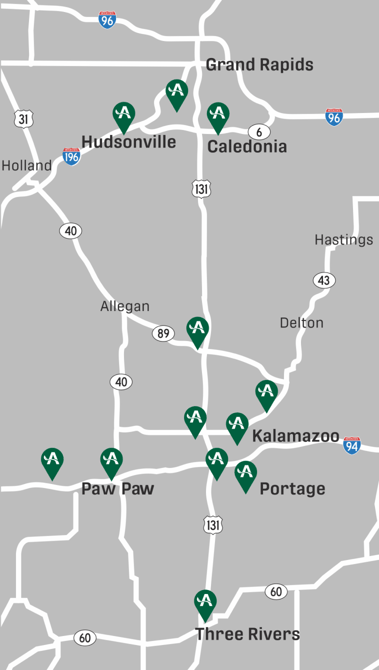

We've Branched Out Across Southwest Michigan

We got our start in 1935 as the Kalamazoo School Employees Credit Union. The goal was simple — to meet the financial needs of our local educators. Since then, our mission has evolved, and we now provide services to all kinds of families and businesses across the state of Michigan. In 2016, we changed our name to Arbor Financial Credit Union to reflect our strong roots in the community and our unrelenting commitment to growth (and to make sure people knew they didn’t have to be a teacher to join!).

- 12 branches across Southwest Michigan

- 47,000+ Arbor Financial members

- $915,000,000+ million in total assets

Who We Are

Everyone at Arbor cares about where we’ve been, where we’re going, and the people we serve along the way. As a credit union and Michiganders ourselves, our purpose is to grow the financial wellbeing of our members and our community, so that we can all share in success.

Working Together

Our staff is dedicated to working together within our surrounding communities. We offer 8 volunteer hours to every employee to use within the year. Within the first year, this program saw great success due to the workplace and community-centered culture that is practiced every day within our branches. Now five years later, our staff has donated over 1,514 hours of volunteer time to our community, schools, nature preserves, and more.

Need volunteers?

We're always ready to help serve our community. Send us an email at marketing@arborfcu.org, and we will add you to our list of volunteer opportunities!

Do the Right Thing

Arbor Financial is located in 12 different communities. With that being said, there are a lot of places that need our help and support. In order to feel connected to our communities and the organizations within them, we developed and dedicated a staff-led committee, known as the Caring Committee. This committee focuses their efforts, funds, and donations on places within our communities that include but are not limited to, local non-profits, animal shelters, children's hospitals, and mental health foundations. Over five years, we have collectively given more than $100,000 in funds, donation items, and volunteer time. On average, 21 employees donate their time to make this committee a success and available to our community.

Having Fun Along the Way

Best of all, we like to have FUN! Arbor Financial supports local high schools through yearbook and theater ads, sponsors everything from little league and other sports teams to local events, expos, fitness facilities, several local chambers of commerce, and even our very own Western Michigan University athletics. Go Buster Bronco! We’re always looking for new ways to get involved in the community — if you have a sponsorship opportunity that you’d like to share, click the button below to join in the fun. join the fun too!

Grow, Wherever You Go

Whether it's great low rates, fun events, or just more peace of mind about your finances, we're here for you. You can find Arbor Financial Credit Union across Southwest Michigan ready to serve you and your community. Check out one of our 12 locations to find out how we can help you grow your financial well-being today.

Join 47,000+ Happy Arbor Financial Credit Union Members

Get started by opening a checking account for free access to more than 30,000 ATMs throughout Michigan and across the nation, fee-free access to Mobile and Online Banking, Web Bill Pay, and more. It's easy to open your Momentum Checking account online or switch your account to become an Arbor Financial member.