GET MORE with Arbor Financial Credit Union.

Combine a free checking account that earns up to 4.00% APY+, mortgages with low rates, auto loans with rates as low as 5.49% APR,6 and the money saved quickly adds up.

Words from our members:

“I Get More with Arbor by receiving incredible loan rates on my vehicle I purchased this year. Additionally, the staff at the branch I bank at are exceptional in their customer service and very friendly.”

Adam S., Arbor Financial Credit Union Member

“I have been a member for over 9 years and the thing I love most about Arbor Financial is the community. I’m so thankful and happy that we live in a community where we can stay close to people through everyday interactions. Joanne, the Centre Street branch manager, was a close friend of mine in high school and I taught her children in school.”

Jane, Arbor Financial Credit Union Member

"Some of our favorite things about Arbor Financial are the online and mobile banking services. We find it so convenient and it makes our life so much easier."

Michelle and Corey, Arbor Financial Credit Union Members

"Great customer service as always!"

Charon M., Arbor Financial Credit Union Member

"We didn't need to call anyone else. We knew Arbor Financial would have what we needed."

Jennifer, Arbor Financial Credit Union Member

"The super low interest rate on our 10 year consolidation loan has helped us pay off our mortgage faster than we ever thought possible."

Jennifer D., Arbor Financial Credit Union Member

"The tellers and staff at Arbor Financial conduct business so professionally and friendly. I feel at home when I enter the branch and see Carolyn and her team.”

Barbara, Arbor Financial Credit Union Member

"Having only been homeowners for a year prior to our refinance, we were a little nervous to go through the loan process. Arbor educated us on our options, walked us through the action items and communicated with us every step of the way. Kyle did an amazing job answering our constant questions and providing in depth explanations that we could understand. The entire process was smooth and timely. We were so impressed and are SO glad we made the change to Arbor Financial!"

Joe G., Arbor Financial Credit Union Member

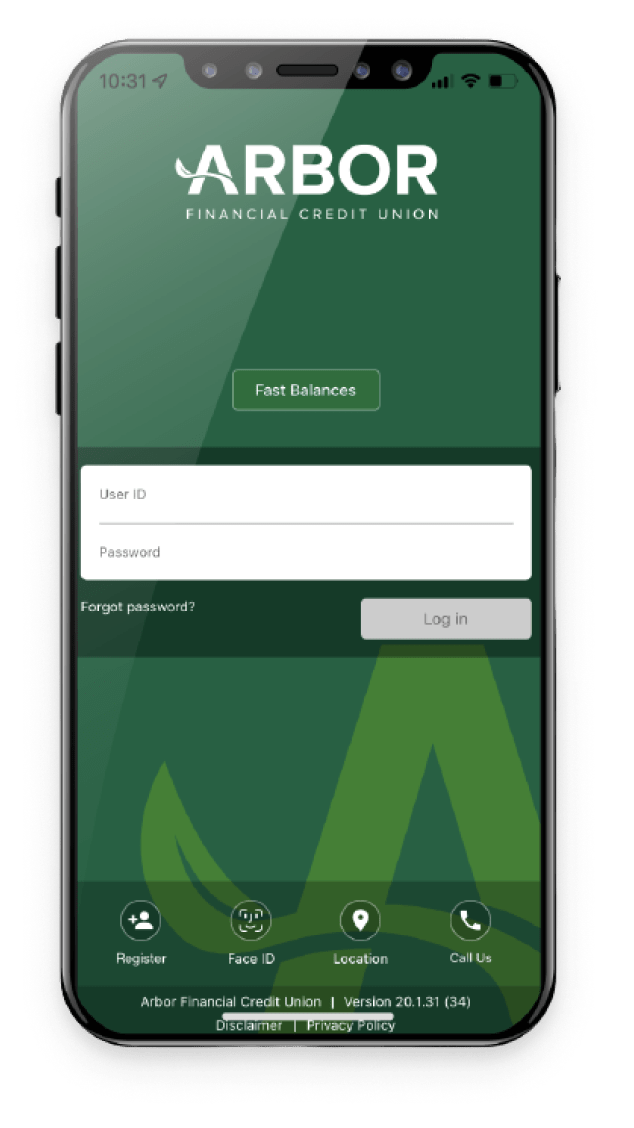

Online & Mobile Banking

Access your Arbor Financial Credit Union accounts anywhere, anytime from the palm of your hand with our free mobile banking app.

Convenient and easy to use, Arbor Financial's Mobile Banking App is safe and secure using some of the most advanced security and technology available.

Education is in our roots.

We believe in financial empowerment and have created a series of webinars, blogs, and free financial tools to help you.

Careers

Don't just find a position - find your people. Our company motto is: Work together. Do the right thing. Be creative. Have fun. There's a reason we've received many workplace awards and our employees love working here. If you're ready to Get More out of your next position, then you're ready for Arbor.9

+Annual Percentage Yield (APY). Rate effective as of 1/1/25. Requires a minimum of 20 debit card purchases monthly. Debit card purchases must post to your account during the calendar month. ATM transactions do not apply. Requires eStatements and a minimum of $500 monthly direct deposit. Interest is not paid on balances over $15,000. One Momentum Checking account per member. Rate is variable and subject to change. If requirements are not met, you do not receive interest for the month. No minimum balance required.

*Both Referrer and Friend must be over the age of 18 to qualify for the reward. Referrer must be a primary member of Arbor Financial Credit Union (Arbor) in good standing with a valid email address on file and refer an eligible prospect (Friend) to Arbor. Friend must open a qualified Arbor membership with a checking account using the Referrer’s referral link and meet the program criteria. The Friend must have two or more direct deposit(s) to their checking account totaling $500.00 or more within 60 days of account opening, and perform 10 debit card Point-of-Sale transactions with the 60 day period. Following qualification, after 60 days Arbor will deposit $90 into the Referrer’s Savings account and $90 into the Friend’s Checking account. An email will be sent upon successful referral completion. Full terms and conditions can be found here.

1. No purchase necessary to enter or win.. Promotional period runs 11/1/25-1/4/26. Click here for official rules

2. Annual Percentage Rate (APR). Rate effective 6/1/25 for a limited time. Rate may vary depending on credit history, term of loan, and underwriting factors. Subject to credit approval. Programs, rates, terms and conditions subject to change without notice. Refinancing of an existing Arbor Financial loan will require $1,000 of new money to qualify for the special rate. Payment example = for a $5,000 loan for a term of 36 months with a 10.99% APR, the monthly payment will be $163.67.

3. Qualifying borrowers may be eligible to defer their first payment for up to 90 days, dependent upon credit score and when the loan closes. Interest accrues from date of loan disbursement and is collected on the first payment(s) applied.

4. Volt account approval may be based on factors such as a qualified parent, child's age, and verification of income. The volt account does not allow members to overdraft the account it simply will not let the transaction go through.

5. Qualifying borrowers may be eligible to defer their first payment for up to 60 days, dependent upon credit score and when the loan closes. Interest accrues from date of loan disbursement and is collected on the first payment(s) applied. Promotional period October 1, 2025 –December 31, 2025.

6. Annual Percentage Rate (APR). Rate effective 4/1/25. Rate disclosed is the lowest rate available and is determined by your credit score and loan to value at the time of application. Certain restrictions apply. Subject to credit and underwriting approval. Program rates, terms, and conditions subject to change without notice. Rate may vary depending on credit history and underwriting factors. Subject to credit approval. Program, rate, terms and conditions subject to change without notice.

7. Annual Percentage Rate (APR). Offer available as of 1/1/26. Balance Transfer promotional rate applicable for 6 monthly billing cycles. Starting on the seventh month, the promotional rate will convert to your standard rate. Not eligible for CU Rewards Points and may not be used to pay other Arbor Financial accounts. Promotion, rate, terms and conditions subject to change without notice.

9. Equal opportunity employer

.png)