- Personal

- Checking & Savings

- Checking

- Free CheckingNo minimum balance or service fees.

Free Personal Checking Accounts

Arbor Financial’s free checking account features absolutely zero fees and allows for easy access to your money at home or on the road. No fees. No hassle. No problem.

These great advantages make our Free Checking Account an easy choice.

We make banking in Southwest Michigan easy. We help you choose the best checking account for you - tailored-fit to meet your unique needs and goals. We’ve loaded our Free Checking Account with perks and benefits you simply can’t say no to.

No Monthly Fees

With our Free Checking Account, you can bank on never having to pay a monthly service charge.

No Minimums

Don’t ever worry about meeting pesky minimum balance requirements. Open your account with the amount that works best for you.

Early Pay

Get paid up to 5 days early for FREE when you set up direct deposit.*

Free ATMs

Punch in your PIN to get cash now at 30,000 surcharge-free ATMs across the nation or visit one of our Southwest Michigan locations. We have offices in Caledonia, Hudsonville, Kalamazoo, Lawrence, Paw Paw, Plainwell, Portage, Three Rivers, and Wyoming, MI.

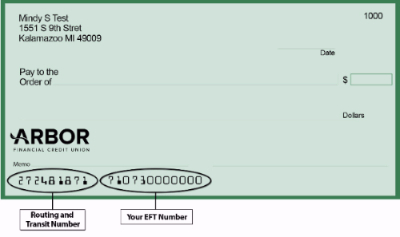

How to set up electronic services for your account:

Receive your paycheck up to 5 days early for free through direct deposit* and set up your electronic payments via your Arbor Financial Checking account. It’s easy.

All you need is:

- Our routing number - 272481871

- Your account number, which is a 12-digit Electronic Fund Transfer (EFT) number and the second set of numbers on the bottom of your check.

Your direct deposit will be finalized through your employer’s HR department. If you require additional help setting up, please refer to the following worksheet.

Free checking account resources

FAQs about Free Checking Accounts

-

To open your Free Checking Account, apply online or visit one of our 12 branches across Southwest Michigan:

- Your Social Security Number or Individual Taxpayer Identification Number.

- Your Driver's License, State ID, Military ID, or Passport.

- To be 18 years of age or older. Under 18? Please stop by any location to open your account.

- If you are opening your new account with funds from another financial institution, you'll need their routing number and account number.

- If you are opening your new account with a debit or credit card, you'll need the card number, expiration date, and CVV code.

- Want another person to sign on the account with you? They will need to enter and validate their personal information.

-

Zip. Zero. Nada. There are no fees with our Free Checking Account - no monthly service fees or pesky ATM fees. We work hard with you to ensure overdraft fees are a thing of the past with our overdraft protection options, so make sure you sign up!

-

Yes! We provide a free Visa Debit Card. Set your own personal identification number (PIN) as an added layer of protection for your debit card purchases.

-

There is no minimum balance requirement, so whether you want to deposit $0, $100 or $1,000, the choice is up to you.

* Direct deposits and other Automated Clearing House (ACH) credits may post to your account up to five days early with the Early Pay service. The Early Pay service is dependent upon when the deposits are originated from the sender and received by the Credit Union, and we cannot guarantee deposits will post prior to their anticipated settlement date. The Credit Union is not responsible for delays in posting due to unforeseen circumstances. The Credit Union, in its sole discretion, may determine whether certain deposit payments, deposit types, or member accounts are excluded from the service. The terms and conditions for Early Pay are subject to change, at any time, without advance notice. Not applicable to business, loan, or mortgage accounts.